Y.Bhargav, Managing Partner, FORECLOSUREINDIA.COM, 25.5.2012:

Hyderabad : Most of the Public sector Banks and Private sector Banks are Auctioning the immovable properties under SARFEASI Act. The rate of success of selling of the properties through Bank Auctions is varying from around 40 % to 60 % depending on the city, market sentiment, political situations etc.

As per the observations during the last two and half years, the primary reasons for less success rate are :

1. Inappropriate reserve price: Some of the Authorized Officers are finalizing the reserve price over and above the distressed price recommended by the Govt. approved valuer. They are some times not considering the external factors like market sentiment like recession, political situations like etc.

2. Lack of publicity to the Auctions : To fulfill the mandatory requirements and save cost of news papers publication, some of the Banks are publishing the Auction Notices in non prominent news papers.

Wide publicity is required like displaying of Banners, distribution of pamplets, publishing in Internet portals etc.Internet users in India are 110 millions, i.e 11 crores, as against All English news papers readers at 20 millions, i.e 2 crores. Publishing in Internet portals is damn cheap at 4 % cost of English news paper advertisement cost and it gives 25 times more publicity.

3. Lack of proper facility to inspect the property in advance: Inspection of the property is being arranged a few days before the Auction date.

Inspection facility is required immediately after publishing of the Auction notice and at least on one public holidays or after office hours so that interested investors and their family members can inspect the property to take appropriate decision.

4. Loan facility to buy these Properties : Some of the Banks and Housing financial Institutions are not giving loans for these properties.

Banks / Financial Institutions will have to come forward to give quick loans to buy these properties to create a Vibrant Bank auctions market / Foreclosures market in India. Interested Investors must also get the sanction of Pre approved Housing loans to buy this type of properties.

5. Lack of awareness among General Public : General awareness is required as they can buy the properties at very attractive prices.

More than 27% of total home sales are foreclosed sales in USA, where as it may be less than 1 % in India.

6.Sentiment about buying properties in Bank Auctions: Some of the people with out having any financial control over their expenditure, are not paying the loans and they are losing their properties.

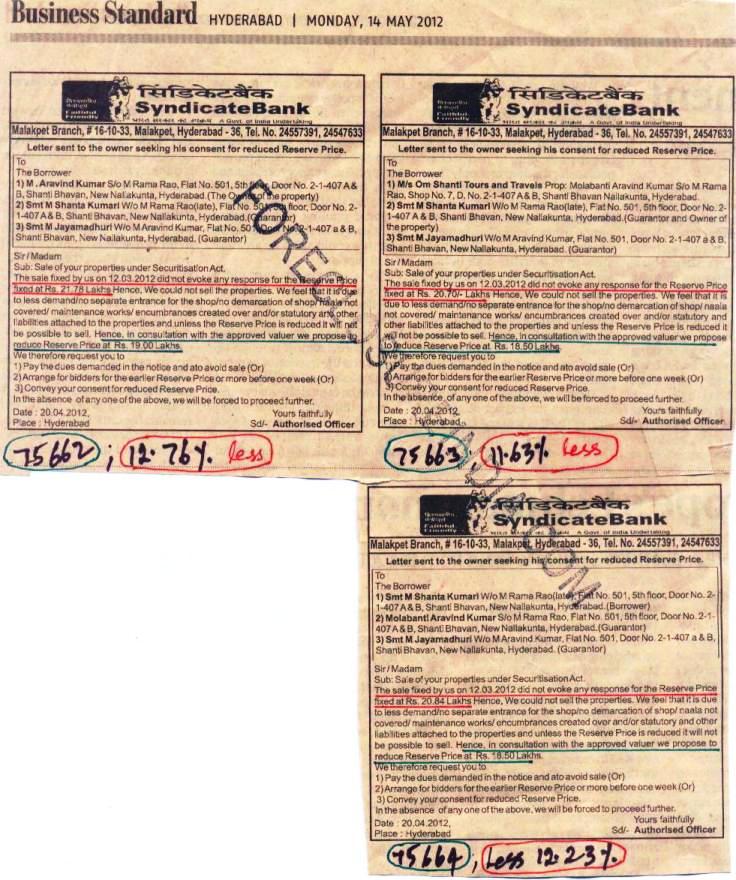

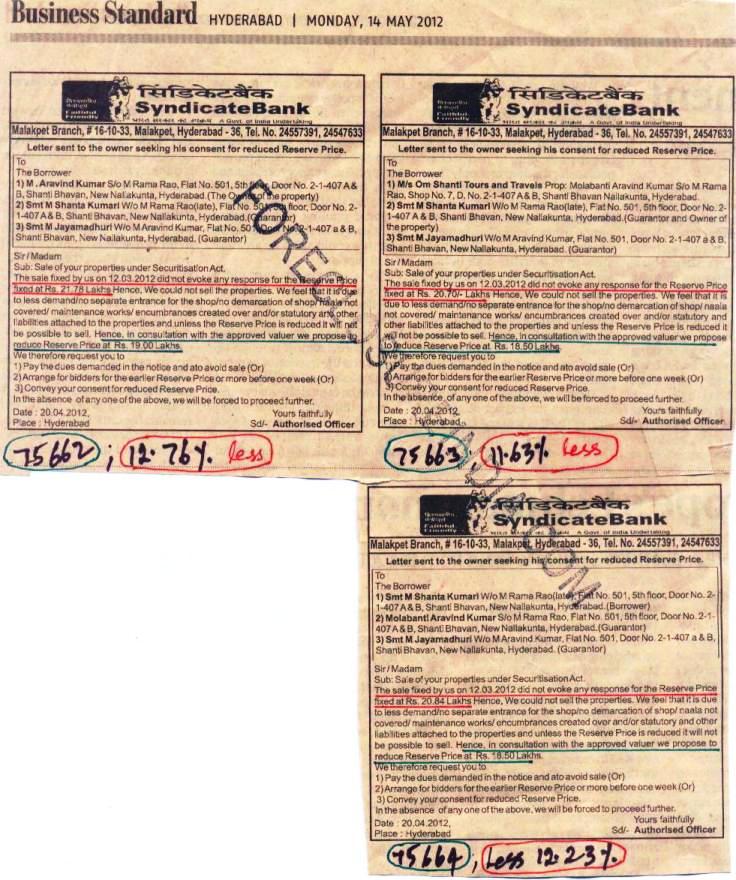

Due to the above reasons Banks and Housing Financial Institutions could not sell around 40 % or above properties and they are laying with them only. To dispose off these properties some Banks are going for re Auction. Some Banks are selling on private treaty, i.e selling the property to anyone who approaches them to buy these properties. Banks are reducing the earlier reserve price also by 5 % to 15 %.

The following advertisement is self explanatory of the above aspects.